SBA Loans for Startups: Guide to Navigating SBA loans to Fund Your Startup

Last Updated: 12/17/2023

SBA loans can provide the business funding you need for your startup and are a great alternative to private lenders in a high interest rate environment. These credits, sponsored by the Small Business Administration (SBA), are financed through approved lenders.

However, the SBA guarantees somewhere in the range of 50 and 90% of the advance should it go into default, encouraging the banks to loan to entrepreneurs with the best rates. Due to the excellent relationship between the SBA and moneylenders, startups can acquire financing to expand their businesses with affordable repayment terms and low-interest rates.

In this guide, small business owners will get detailed information regarding SBA, SBA loan, SBA loan types, qualifying criteria for startup SBA loans, qualifying SBA lenders, and application for SBA loan.

What is SBA?

SBA is an abbreviation representing the Small Business Administration. The Small Business Administration is a government office in the US devoted to helping business enterprises to upgrade their business activities and gain admittance to venture credits.

What is an SBA Loan?

SBA loans are small business credits guaranteed by the US Small Business Administration (SBA) and granted by different approved lenders, such as banks and microfinance establishments. SBA mitigates the moneylenders’ risks by guaranteeing up to 80% of the credit sum. Through SBA credits, small business owners can get cash to purchase business equipment, settle bills, and refinance other debts.

Need a business plan for the SBA? Create a lender ready business plan with financial forecasts in minutes with AI using ProAI’s business plan generator.

SBA Loan Programs

The most well-known SBA loan programs incorporate SBA Express Loans, SBA 7 (A) Loans, SBA 504 financing, SBA Microloans, and Disaster credits. Coming up next is a concise feature of the SBA credit types.

SBA Express Loans

SBA Express Loan is a facility intended to be repaid for an extended period, and it is ideal for your working capital necessities. To be eligible for this advance, you must be a US resident or a green card holder with a business over 18 years of age.

With SBA Express Loan, you can get up to $350,000. A loan up to $100,000 doesn’t need any evidence of income. Notwithstanding, credits above $ 100,000 require two years of business record and personal tax returns.

The interest rate on this advance changes quarterly, and it ranges from prime plus1 to prime plus 4. The loan repayment period is between 3–5 years; however, there is a choice to extend it to 7 years.

SBA 7 (A) Loans

SBA 7 (A) loans are ideal for your working capital needs, business development, and fixed assets. They can also be used for startup business loans if you are prepared to stake your personal credit score and assets. Those qualified for this facility are US residents or green cardholders.

SBA 7 (A) Loans are reasonable for loan proceeds applied towards long-term and short-term assets utilized in new business activities. The SBA loan program offers up to $5 million, and to get it, you should provide three years of business returns and two-year individual returns.

The interest rate for this credit varies between 1–2%. Although SBA doesn’t loan to startups, it manages banks’ costs. For instance, SBA requires moneylenders to charge 2.75% over the prime rate for a seven-year advance term.

Need a business plan for your SBA 7a Loan? Create a lender ready business plan with financial forecasts in minutes with AI using ProAI’s business plan generator.

SBA 504 Financing

SBA 504 financing is a long-term credit facility offered at a fixed rate. For a private venture to qualify for this item, it must own more than 51% of the real estate business and meet all the federal government business requirements. This product is ideal for financing fixed assets, such as equipment or houses.

The credit sum offered is up to $5 million, and the loan fee you pay for the first mortgage loan can be either fixed or variable. However, for the subsequent home loan, you will pay a fixed rate at around prime minus 1. You should bear in mind that the first mortgage is paid up to 25 years, and the second one for a limit of 20 years.

SBA Microloans

SBA Microloans are offered to cater to working capital, stock, equipment, and business startup. The loan offered is up to $50,000, and it is processed through NGOs inside the network. Note that SBA doesn’t secure microloans, and they can help small businesses that can’t acquire the little credit from the conventional banks. The SBA Microloans are repayable between 1–6 years.

SBA Disaster Loan

SBA Disaster Loan is a credit facility intended to help small business owners affected by natural disasters, such as floods or pandemics. The loan amount offered is up to $2 million, and it is disbursed through SBA.

Who Qualifies for SBA Loan?

All businesses can qualify for SBA loans as long as they have a decent credit score. Before you apply for an SBA credit, remember that it requires much documentation, and it takes time for the loan to be approved.

If you need to develop your business, don’t spare a moment to go for an SBA credit. Also, just remember if this is a startup business loan you will likely be required to stake your personal assets and credit, similar to personal loans.

Here are the requirements for qualifying for an SBA loan program:

• A credit score of at least 620

• You must have at least two years of work experience in maintaining your business. However, startups can qualify for the microloans without this necessity.

• You must have more than $100,000 yearly income

- You must be doing business in the US

Qualifications for SBA Lenders

The SBA has three loan programs: 7(a), CDC/504, and Microloan. Each loan program has its loaning practices and qualification requirements for moneylenders. Audit the features of each, then decide which option is ideal for you.

Have questions about business planning or the capital raising process? Contact our experts at Pro Business Plans by scheduling a free consultation.

7(a) Credit Program

Banks, savings and loans, credit associations, and other specialized moneylenders take an interest in the SBA on a deferred basis to offer business loans that are structured under 7(a) rules. If a borrower defaults on an SBA guaranteed credit loan program, the lender would request the SBA to buy the guaranteed amount.

To partake in the 7(a) advance loan program, a lender must meet the following criteria:

o Have a continuing ability to assess, measure, close, disburse, service, and liquidate small business loans.

o Be available to general society to give credits (and not be a financing auxiliary, connected principally in financing the tasks of a partner).

o Have a great character and reputation, and in any case, meet and keep up the moral necessities as distinguished in 13 CFR Part 120.140.

o Be administered and analyzed by a state or government administrative power, palatable to the SBA.

CDC/504 Advance Program

A Certified Development Company (CDC) is a non-profit organization set up to contribute to the economic development of its community. CDCs are certified and regulated by the SBA. They work with the SBA and private-sector credit to provide growing businesses with long-term and fixed-rate financing for major fixed resources, such as land, building, and equipment.

Commonly, a project involving a 504 credit incorporates:

An advance secured from a private segment bank with a senior lien concealing to 50 percent of the venture cost.

An advance secured from a CDC and backed by a 100% SBA-ensured debenture — with a lesser lien covering up to 40 percent of the total cost, and at least 10% of the borrower contribution.

To partake in the CDC/504 advance program, a lender must meet certain conditions, including but not limited to:

o Be a charitable enterprise on favorable terms

o Have a board of directors with at least nine voting directors

o Have full-time professional administration and a full-time proficient staff

o Meet a minimum level of credit activity.

Microloan Program

The Microloan program offers small businesses with small loans of up to $50,000 — for working capital or to purchase stock, supplies, furniture, fixtures, equipment. The SBA makes finances accessible to uniquely assigned designated lenders, which are non-profit associations with experience in loaning and specialized help. These middle people, at that point, issue advances to qualified borrowers.

To take part in the Microloan program, a lender must meet the following requirements:

o Be a private non-profit, quasi-public, or family-owned organization.

o Have more than one year of experience in the lending and recoveries of microloans

o Have at least one year of experience providing in-house marketing, management, and specialized help to its Micro-borrowers.

Summary Overview

Step by Step Instructions to Applying for an SBA Loan

SBA business loan application includes a length cycle, and, accordingly, you must patient as you seek it. Note that before moneylenders conclude whether to give you the advance, they need to audit your credit history and financial records.

If you need to improve your chances of getting an SBA advance, it is essential to have your collateral ready prepared because it is one of the necessities for some credit types, especially loans for startups. Likewise, note that another qualification for this advance is your business performance.

Moreover, a few reports, such as business plans are fundamental while applying for an SBA advance. Be ready to fill in a detailed loan form with specifics concerning collateral, business, and a clarification on how you will utilize the credit.

In short, coming up next is a rundown of a portion of the reports small business owners need to apply for an SBA advance:

• Personal tax returns

• Business tax returns (for established businesses)

• Bank statements

• Business plan

• Driving permit

• Profit and loss statements (for established businesses)

- Statement regarding your own set of experiences

- Business rent

The SBA Loan Process

Conclusion

SBA advances are credit facilities guaranteed by SBA and offered by approved moneylenders to assist businesses with working capital and different necessities small businesses often have.

The the SBA guarantee is up to 80% of the advance sum, implying that the obligation will be reimbursed if there should arise an occurrence of default. Through this assurance, moneylenders can serenely propel credit to little business people, notwithstanding their risks.

Commonly Asked Questions

How will the SBA review my business plan?

Having a solid business plan is important for the SBA to review your regional market, competition, startup costs or other business expenses, and management qualifications. You can quickly put together a quality business plan with AI using a tool such as ProAI.

While having a solid business plan isn’t enough by itself, it can help you to communicate information that may help you appear more qualified. Financially, the SBA wants to know that you realize how much startup funding you require and that you have budgeted accordingly.

I have bad credit, what are my options?

Before applying, we suggest checking your personal credit scores. Unfortunately poor credit is a non-starter for many lenders, including the SBA loan programs, this is especially true for startup businesses. We recommend working to try and increase your credit by resources available online.

What if my bank or credit union doesn’t offer SBA loans?

This may be the case with smaller community banks, if so, we suggest you get a referral from your existing bank or see the question below.

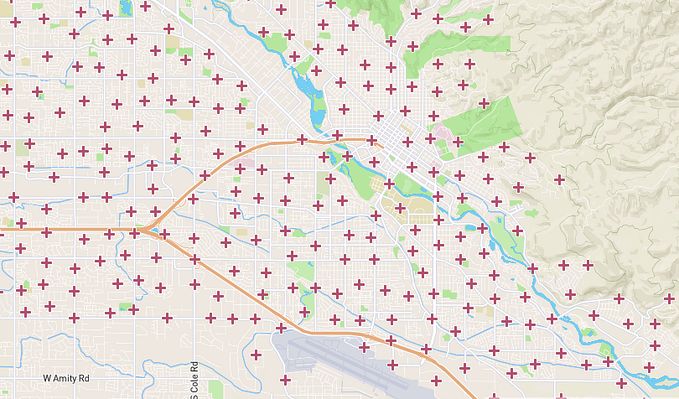

How can I find an SBA approved lender?

You can contact your existing credit union or financial institution to find an SBA approved lender, and ask to get an SBA loan, but a few common ones are:

- Bank of America

- Wells Fargo

- JP Morgan Chase

- TD Bank

- Online lenders

How can I get an SBA startup loan?

SBA startup loans, unlike are a traditional loan, are treated as personal loans by the business owner — offering them no financial protection — but they also take into consideration your business potential.

Getting an SBA startup loan is a lot like getting a personal loan, although the rates and terms may be better since SBA startup loans are part of a federal program. However, if you don’t qualify for an SBA startup loan based on your personal credit, you may want to explore other startup funding options.

How do I prepare financial projections?

We recommend using an existing financial model template to prepare your startup expenses, revenue projections, and other long term budgeting. There are several templates available online. This can be challenging for an SBA startup loan since you lack operating history, so make sure to do ample research during the creation of these projections.

What are other startup businesses funding options?

Venture capital or angel investors are a common alternative for startup businesses. The advantage of using these methods is that unlike startup loans, they do not require you to risk your personal credit score and require collateral.

However, you will need to give equity away that can be as high as 50% in some cases. There are also some small business innovation research grants available if your business idea involves ‘deep tech’ or is research related.

Loans for startups in particular can be expensive, and have interest rates like business credit cards, outside of the SBA, so we recommend exploring all options rather than exclusively focusing on a small business startup loan.

What percent of people who apply get an SBA loan?

Every year, many people apply for a small business loan, but only a portion are approved. On average, SBA loans have a 52% approval rate.

Can I qualify for a business credit card?

Generally speaking — no your startup cannot qualify for a business credit card in the sense that you will be personally liable for the balance and it can affect your personal credit score. Larger businesses may be able to have a business credit card after it has demonstrated a track record, but this is not the case with early stage companies, especially those with no prior startup funding.

Pro Business Plans is a leading team of business plan writers according to Wimgo, a professional services ranking website.